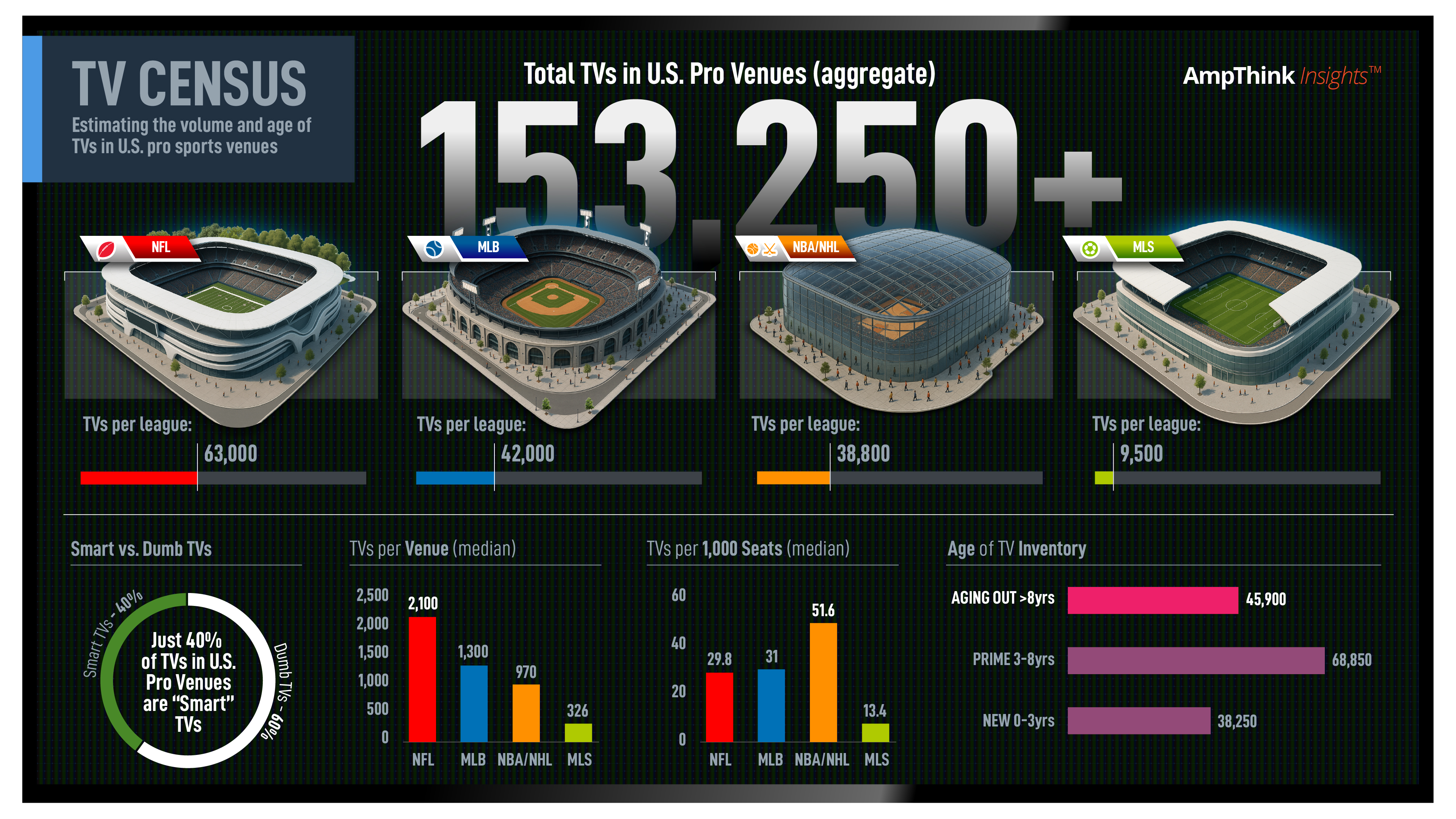

Have you ever stopped to think how many TVs there are in pro sports venues? We did—so we conducted an informal census. The final numbers surprised us: 153,000 TVs across U.S. stadiums and arenas.

Who has the most TVs? The NFL leads in total TVs (and in median per venue, ~2,100).

Where is the highest density of TVs? Arenas (NBA/NHL)—by a wide margin—top the charts for screens per 1,000 seats, driven by a high concentration of suites and clubs (i.e., premium spaces) per square foot.

Tech mix & age: Smart TVs comprise ~30–45% of large-venue stadium endpoints and rising. Every refresh cycle is pushing more screens onto the IP network. More smart TVs mean fewer DMPs (cost), faster installs, lower power/maintenance, and the potential for cloud-based content updates.

How TVs are used (typical mix): Live video (game action): 60%; Menu boards: 20%; Static/wayfinding: 12%; Suite-specific: 5%; Back-of-house: 3%.

Caveat: Public data on screen counts is sparse. We gleaned data from published sources and extrapolated to generate league medians. We consider these numbers directionally correct.

Application: TV screens are more than a fan amenity; they’re a monetizable media layer. With a modern CMS managing smart TVs, venues can activate sponsorship by zone, switch playlists by event mode, and tailor menu-board offers to lift POS.

If you’re thinking about how to turn your TV network into programmable revenue, AmpThink’s CMS, Ampboards, was built for exactly that: zone-by-zone control and easy content changes without a player behind every screen.

Garland, TX 75042